Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

March 10, 2022

The escalation of events provoked by Russia’s invasion of Ukraine has amplified risks to the global economy. The potential disruption to key commodities such as oil, gas, wheat, and certain minerals may cause inflation to increase further in the short term, though this will depend on how long pressures are sustained. The economies of the U.S., Canada and China are sufficiently resilient to withstand higher inflation and some disruption to commodities, though we acknowledge that Europe in particular faces a higher risk of recession due to its dependence on Russian energy imports. A more detailed review of our global economic forecast will be published in our April Economic and Capital Markets Outlook available early next month.

Equity market volatility has increased as headline risks have risen. Year-to-date to February, the S&P 500 (Canadian dollars) fell -7.8%, the S&P/TSX decreased by -0.1%, and the MSCI World dropped by -7.4% (Canadian dollars). In general, our portfolios have fared better than the indexes.

Risk to Outlook: Geopolitical

The geopolitical situation unfolding in Ukraine bears close watch and we are evaluating alternative adverse scenarios. As Russian armed forces continue to push toward the capital of Kyiv, Western leaders have pledged support to Ukraine by providing the country with military equipment and implementing sanctions on Russia.

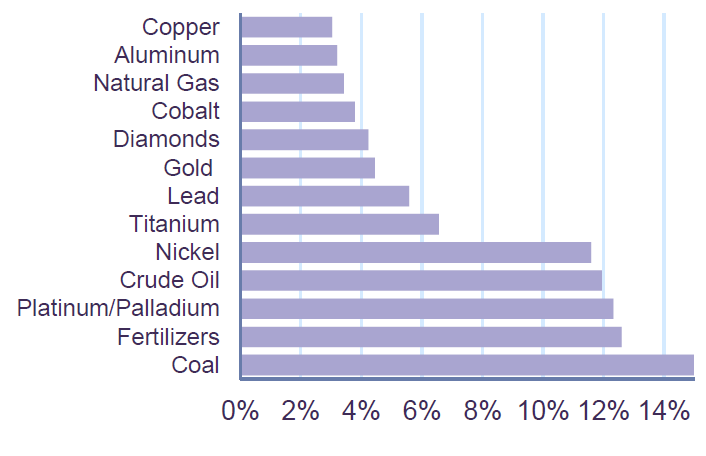

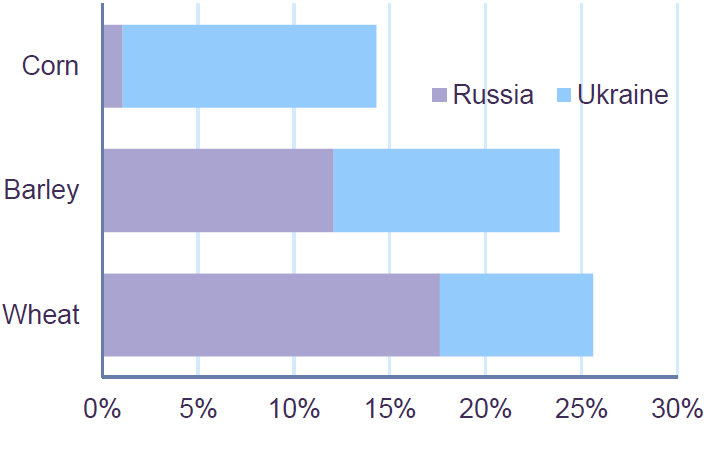

An immediate economic consequence of the invasion is the halt in trade between the European Union and Russia. For the E.U., total exports and imports to Russia account for only 0.5% and 0.9% of GDP respectively, whereas, for Russia, exports to the E.U. are 8.9% of GDP and imports are 5.1%. This understates however the importance of Russian trade in vital commodities, particularly with the E.U. where 40% of the natural gas and 25% of the crude oil consumed are imported from Russia. The conflict has pushed commodity prices higher, particularly oil, fertilizers, grains, and metals. As illustrated in Charts 1 and 2, Russia and Ukraine are important worldwide commodity exporters. Most notably, Russia produces 10% of the world’s oil exports, and Russia and Ukraine account for over 25% of the world’s wheat exports. The commodity-focused companies in our portfolio have seen their share prices rise sharply during this period on the back of fears of disruption to global supply.

Russian Share of Global Exports (2020)

Share of Global Food Exports (2020)

In our global equity mandate, we entered the crisis with minimal direct exposure to Russia and Ukraine held through our Emerging Markets Equity Fund. We took an active decision to liquidate two Russian companies just prior to the invasion and exited at a profit. The remaining exposure in Russia and Ukraine is nearly zero, and therefore non-material.

Risk to Outlook: Inflation

The U.S. Core Consumer Price Index, a measure of the changes in the price of goods and services excluding food and energy, increased 6.0% in January, the fastest pace since 1982. The spillover effect of the conflict in Ukraine has driven food and energy prices higher all over the world and will likely lead to higher headline CPI. We estimate that the short-term impact of higher energy and wheat prices alone could add around 2% to CPI, which could temporarily push the index towards a 10% annual rate of increase. This will ultimately be dictated by the extent and duration of sanctions and supply disruptions, which are currently very difficult to forecast.

While we still expect that major central banks will continue to address rising price pressures by hiking policy rates, they should not significantly accelerate their plans. The Bank of Canada increased rates by 25 basis points in its last meeting and it is widely expected that the U.S. Federal Reserve will soon follow suit. The runup in oil prices does augment the risk that consumers will be forced to reduce spending on other items, however, we note that the world has seen higher expenditure on oil relative to GDP in the past. We believe that the U.S. economy is resilient enough to withstand the impact, and this is likely the case for Canada and China. As noted above, Europe faces more uncertainty, raising the risk of a material slowdown or recession.

Concluding Thoughts

Despite the backdrop of inflation and geopolitical risk, the underlying outlook for the global economy on balance remains positive, although not evenly distributed regionally. From a portfolio strategy standpoint, we are continuously balancing the risks to the forecast with an assessment of the investment potential of companies whose share prices may offer an opportunity and/or may be part of the solution to these events. Furthermore, in the current environment of heightened concerns and market volatility, we would like to assure you that the portfolio is well diversified by geography and industry, trading at a very reasonable valuation and supported by an attractive dividend yield. Our fixed income portfolio is structured with high-quality securities with relative short durations, defensively positioned for a period of gradually rising interest rates. We are confident that your capital remains invested in a prudent manner.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN