Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

December 2023

Following consecutive months of volatility, global equity markets rebounded strongly in November due primarily to positive developments on the inflation front. Year-to-date, the S&P 500 returned 20.9% (in Canadian dollars), S&P/TSX 7.5%, MSCI Europe 15.2%, MSCI All Country World Index (ACWI) 16.7% and MSCI Emerging Markets 5.8%.

Inflation continues to slow in most major economies, indicating that central bank policy rates may have peaked and the monetary tightening cycle is nearing an end. The market is currently signaling no further rate hikes from both the Bank of Canada and the Federal Reserve, and the possibility of rate cuts in March 2024. Nevertheless, the lagged effect of tighter monetary policy will continue to weigh on economic growth, with a softening labour market likely to temper consumer spending. We will offer a more comprehensive perspective on our outlook for the global economy in our forthcoming Economic and Capital Markets Outlook, scheduled for publication at the beginning of 2024. Meanwhile, our investment strategy remains unchanged, focusing on companies trading at comparatively lower valuations and with higher growth rates than the overall benchmark.

Navigating Volatility

A year ago, many believed that an economic contraction in 2023 was highly likely to occur. Our view – that the global economy was headed for slower growth and a recession was a much less probable outcome – appeared to be an outlier. Today, the IMF forecasts that world real GDP will grow by 3.0% this year and equities have generated solid returns year-to-date.

The adjustment to higher interest rates has not been smooth, an outcome that we also expected. The first quarter saw the collapse of two U.S. regional banks and there were concerns that this could lead to contagion in the broad banking sector. The S&P 500 fell 7.8% from its early-February high. Further volatility occurred in September and October due to uncertainty surrounding interest rate hikes and economic weakness in China, resulting in a decline of 7.0% over the two months.

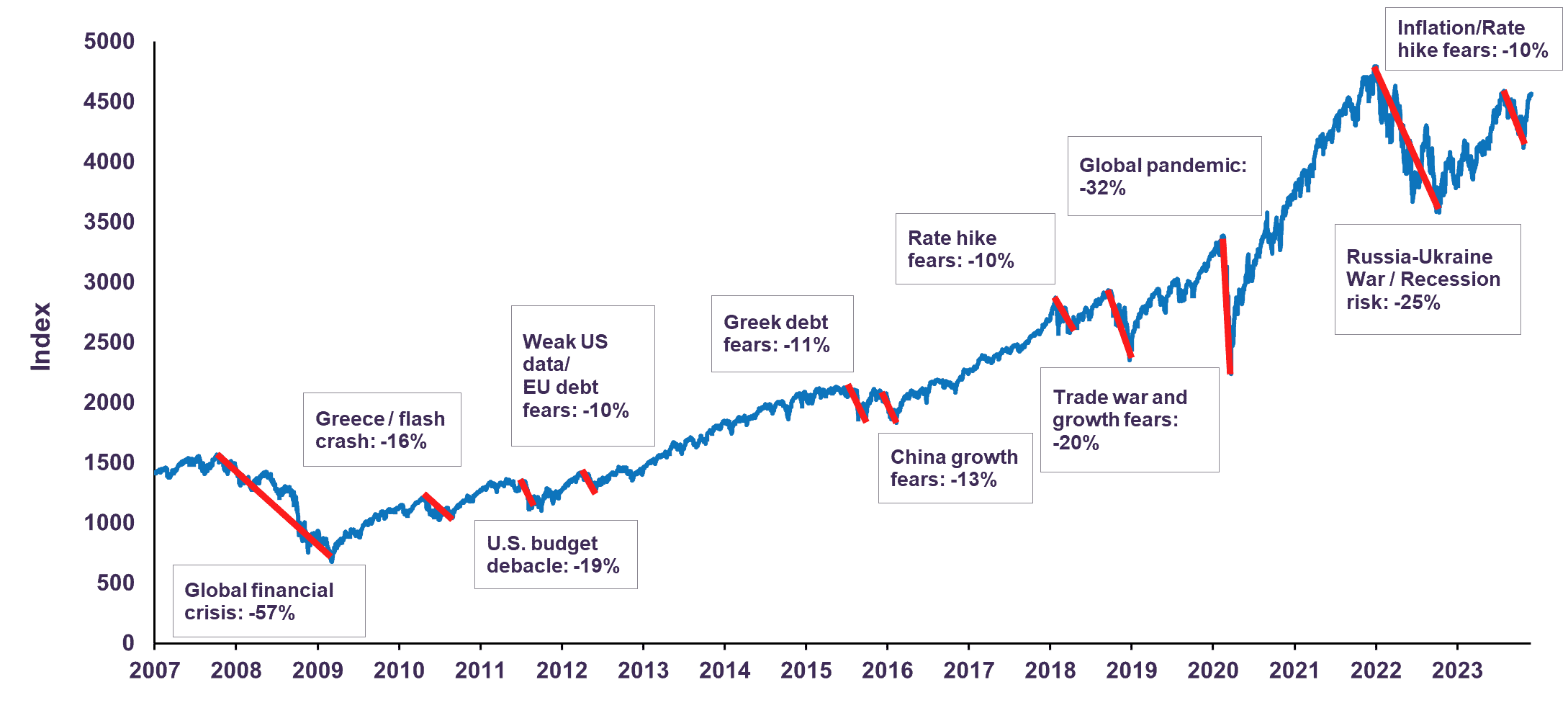

Though there is now a higher risk of a more pronounced slowdown in 2024, we believe that our portfolios are positioned to weather the uncertain environment. As shown in the graph below, investors with a long-term focus have notably benefitted from the positive underlying trend of the market (Graph 1).

S&P 500 Corrections of 10% or more

Concerns in the Private Equity Market

While our investable universe is publicly traded global equity and Canadian fixed income securities, we remain abreast of the developments across all asset classes. In the past decade, institutional investors have shifted a considerable amount of their assets from liquid and transparent public markets to illiquid and opaque private markets. Unlike public markets where assets are marked-to-market daily, valuations in private markets are appraised, influenced by historical pricing and communicated infrequently. These factors create a downward bias on reported volatility leading to the false perception that private markets deliver “smoother returns” and are not correlated to public markets.

As stock prices fall, a portfolio containing an allocation to private equities will appear to drop less. Investors in private equity funds can derive a false comfort and be unaware of the extent to which the true value of their investments has declined. We are seeing evidence of this in the widening of spreads between the unrealized returns reported by private equity firms and the real cash returns delivered to their investors. To put it plainly, there is a growing disparity between the promised paper profits and the actual realized returns.

U.S. private equity buyout fund leverage is at a historic high, 6.9x debt-to-EBITDA ratio compared to 1.4x in the public markets. [1],[2] The burden of one of the fastest rate hike cycles in history will be greatest on the firms with the highest debt levels. Indeed, the International Monetary Fund’s latest Global Financial Stability Report points out that “privately traded assets may not have fully adjusted to higher interest rates”.[3] After a period of exponential growth in commitments to private equity funds fuelled by low interest rates, we are concerned about the health of the private equity market today.

We invite you to peruse our in-depth analysis of this asset class: Private Capital Unveiled: Critical Considerations for Investors.

Conclusion

As we noted above and in our past letters, market volatility can be uncomfortable. Our portfolios consist of investments that are valued daily. Any sense of optimism or pessimism is instantly priced into our portfolios. It is important to look beyond these short-term gyrations as quality companies will grow over time. Overly pessimistic views often present an investment opportunity.

Major shifts in asset allocation are not warranted at this time, though we continue to make gradual changes to our fixed income and equity holdings. Our equity portfolios are well-diversified across sectors and geographies, trade at an attractive forward price-to-earnings multiple of 10.3x and offer a solid dividend yield of 3.6%. Our fixed income portfolios are primarily composed of medium-term Canadian government bonds with a notable exposure to high-quality corporates. The yield on our bond portfolio is 4.6%. This disciplined investment approach should both preserve and grow your capital over time.

[1] McKinsey. Global Private Markets Review 2023. Retrieved from the following link.

[2] Bloomberg, MSCI World Index, debt-to-EBITDA ratio for 2022.

[3] International Monetary Fund. Global Financial Stability Report, October 2023. Retrieved from the following link.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN