Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

April 2025

Global equity markets experienced a marked increase in volatility over the past month as investors reacted to escalating trade policy uncertainty. As of time of writing, President Trump has announced a 90-day suspension on reciprocal tariffs for most nations, while maintaining a baseline 10% tariff on all imports to the U.S.—with the exception of China, where tariffs have been raised to 145%. This policy shift follows the April 2nd announcement—referred to as “Liberation Day”—where the administration introduced a sweeping set of new tariff measures.

In response, China has raised its reciprocal tariffs on U.S. goods to 125 %. While no new tariffs have been introduced for Canada or Mexico, both countries have been subjected to a 25% tariff on imports not compliant with USMCA, including a 25% tariff on foreign autos imported to the U.S. The Canadian government has since indicated it will match these auto tariffs. With further retaliatory actions likely from other nations, global trade relations remain under strain. The full impact on the economy and capital markets remains difficult to predict at this juncture and will depend largely on the duration and scope of these tariffs.

The uncertainty surrounding trade policy has contributed to headwinds for U.S. equities, with the S&P 500 declining by 8.1% year-to-date as of April 9th (total return in Canadian dollars). This follows two years of strong double-digit returns, during which market concentration increased and valuations in certain segments became stretched. Canadian equities have also edged lower, with the S&P/TSX Composite Index posting a decline of 3.3% over the same period. Similarly, international equity markets have also seen declines, with MSCI EAFE down 4.7% and MSCI Emerging Markets down 8.2%.

Looking ahead, while tariffs and ongoing trade policy uncertainty have raised concerns over a potential global downturn, we believe it is premature to conclude that these developments will lead to a broad-based recession. As outlined in our Q2 2025 Economic and Capital Markets Outlook, global growth is expected to remain subdued, with global real GDP projected to expand by approximately 3.0% in the year ahead.

The Case for Diversification in Volatile Markets

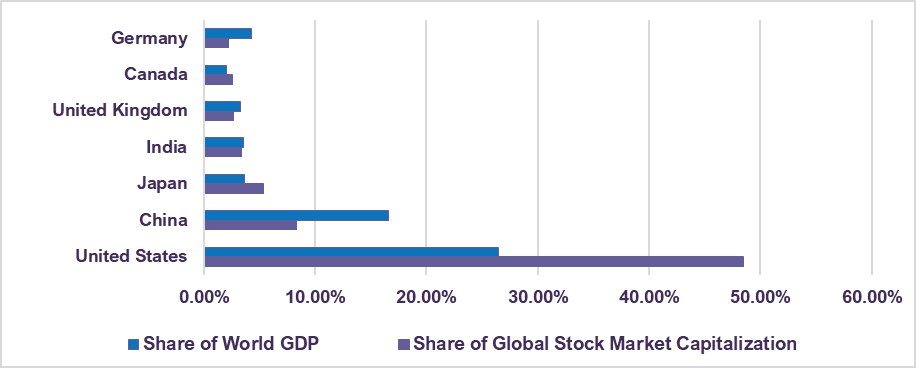

The recent turbulence in equity markets underscores the importance of well-diversified portfolios and prudent risk management. The U.S. now accounts for nearly 50% of global stock market capitalization, despite representing only 26% of the global economy (Chart 1). This level of market concentration is the highest level on record and raises questions about the sustainability of recent market leadership.

In light of this, a well-diversified portfolio should be balanced across geographies, industries and companies to mitigate the risks inherent in any single market. Market leadership shifts over time—historically, periods of extended U.S. outperformance have been followed by stronger returns in international markets. For example, in the late 1980s, Japan accounted for nearly 50% of global stock market capitalization while contributing just over 15% to the global economy. Today, Japan represents approximately 5% of global equities and less than 4% of the global economy, a reminder that market concentration can be cyclical. Maintaining diversification helps ensure more stable returns amid market turbulence and as leadership evolves over time.

Share of Global Stock Markets vs. Share of Global GDP by Country (2024)

The Role of Risk Management in Long-Term Value Creation

As equity markets continue to experience volatility, the importance of risk management remains paramount. Risk may take many forms and varies by investor definition. While some investors assess risk based on how a portfolio’s returns fluctuate relative to the market, at LetkoBrosseau, we define risk as the permanent loss of capital. Our approach mirrors that of business owners evaluating long-term value creation: we analyze market position, product quality, cost structures, profit margins, debt levels, growth potential, management quality, regulatory environment, industry dynamics, and the price paid relative to intrinsic value. This disciplined framework enables us to assess risk based on fundamental merit rather than relying on market consensus or index composition.

Market volatility, while unsettling in the short-term, also presents opportunities for disciplined, long-term investors. By focusing on the intrinsic value of companies and maintaining a consistent investment philosophy, we aim to weather the turbulence and remain focused on long-term growth. In an environment characterized by trade policy uncertainty, elevated evaluations and concentrated market leadership, we remain cautious, selectively taking profits and raising cash as companies approach their intrinsic value.

On balance, portfolio activity has been measured, with exits from select positions, including several in the IT sector—specifically Celestica, Oracle and SAP—where valuations had become increasingly stretched. These exits have been partially offset by redeploying capital into existing positions that are trading at more attractive valuations. The initiation of new positions has been minimal, reflecting our prudence in the current market environment. As a result, our portfolios hold a moderate level of cash, affording the flexibility to deploy capital opportunistically as we continue to monitor market conditions.

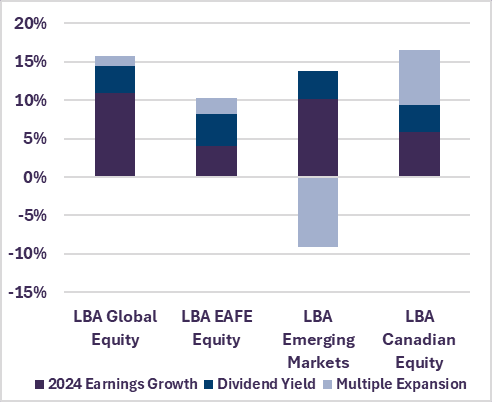

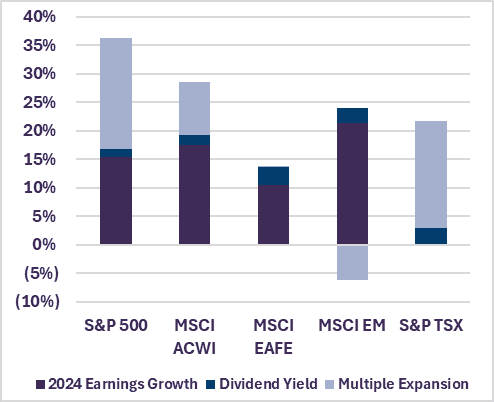

Our global portfolios have remained resilient, supported by strong business fundamentals, such as earnings growth and dividend income, rather than relying on price multiple expansion—where stock prices rise without a corresponding increase in earnings. Unlike broader U.S.-centric equity indices, where a significant portion of returns appears driven by multiple expansion, we believe that true value is created through sustainable earnings growth and a focus on risk-adjusted returns (Charts 2 and 3). We remain committed to delivering long-term value, while avoiding the pitfalls of short-term market fluctuations driven by speculation or investor sentiment.

Sources of LetkoBrosseau Performance (based on 2024 total return)

Index Returns Decomposed (based on 2024 total return)

Concluding Thoughts

Periods of heightened volatility reinforce the importance of a disciplined risk management framework and a steadfast commitment to long-term objectives. In response to shifting market conditions, we have adopted a cautious approach—reducing exposure in areas where valuations appear stretched and reinforcing positions in companies with solid fundamentals and attractive long-term prospects. Unlike certain broad equity market indices, which have become increasingly concentrated in a handful of high-valuation stocks, our portfolio remains diversified across sectors and geographies, emphasizing businesses with sustainable earnings and resilient cash flows.

With a moderate cash position, we maintain the flexibility to act decisively as market dislocations create opportunities, while positioning our portfolios to navigate a potentially more turbulent period for equities.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN