Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

April 2025

- Tariffs and trade policy uncertainty have raised fears of a global downturn. Though the climate of uncertainty has heightened risks, we believe it is too soon to conclude that current events will trigger a broad-based recession.

- The world economy is on solid footing heading into this period of trade disruption. Most major economies possess several levers to help mitigate external shocks. We anticipate another year of subdued growth and expect global real GDP to expand by about 3.0% in 2025.

- We believe sustained spending by higher income Americans will anchor consumption amid a softening labour market. Our outlook is for U.S. real GDP growth to advance between 1.0-2.0% in 2025.

- The threat of tariffs complicates what is otherwise a relatively sanguine outlook for the Canadian economy. Nonetheless, we expect real GDP growth in the 0.5-1.5% range for Canada in 2025.

- Activity in the Eurozone remains soft, but the ECB’s supportive stance will help the region navigate current headwinds. Our forecast is for Eurozone real GDP to expand by 0.5-1.5% in 2025.

- Prospects for China vary based on different tariff and policy-response scenarios. The IMF’s current forecast is for Chinese real GDP to grow by 4.6% this year. In aggregate terms, emerging market activity is forecast to remain stable at 4.2% in 2025, per IMF estimates.

- Equity markets were volatile in the first quarter. In this environment, careful stock selection and price sensitivity remain paramount. We are comfortable holding a moderate level of cash to allow us the flexibility to capitalize on market dislocations in a potentially tumultuous period for equities.

Summary

Punitive U.S. tariffs destabilized markets in the first quarter. The prospect of retaliatory measures and further escalation amid U.S. plans for reciprocal, regional, and product-specific levies has led to widespread fears that tariff and trade policy uncertainty could soon tip the global economy into a downturn. Though we acknowledge tariff-related risks have risen, we believe it is premature to forecast a recession.

U.S. trade actions exceed what was seen in the first trade war. We note, however, that several tariff measures feature meaningful exemptions. Furthermore, the ultimate impact on aggregate activity will depend on their duration and scope, both of which remain indeterminate.

We recognize that the climate of uncertainty is negatively impacting consumer and business sentiment, and this could spill over to lower spending. Despite these challenges, our base case is for global activity to stay on a positive growth track for 2025. The world economy is on solid footing heading into this period of trade disruption, and most major economies possess fiscal, monetary and other levers to help mitigate tariff-related headwinds.

We have reviewed our economic growth forecast against this backdrop, and at present, we are not making any significant revisions to our base outlook. We anticipate another year of subdued growth and expect global real GDP to expand by about 3.0% in 2025.

That said, we remain of the view that swings in sentiment pose the biggest risk at present, both from an economic and financial markets perspective.

Consensus expectations for strong earnings growth and historically high market multiples remain at odds with the projected level of economic activity. We maintain that the most suitable strategy for the current environment is an active approach that emphasizes price sensitivity, careful stock selection, and a moderate cash reserve.

U.S. headed for a mild deceleration

The U.S. economy closed 2024 on a strong note. Real GDP advanced 0.6% quarter-on-quarter in Q4 2024 as household consumption (+1.0%) and government spending (+0.8%) more than offset weak business investment (-0.7%). In real annual terms, the economy grew by 2.8% in 2024. While we expect the economy to continue to expand in the year ahead, we believe a moderate deceleration is in the cards.

Job market data indicate somewhat weaker employment trends compared to last year. In the first two months of 2025, job gains averaged 138,000 per month, down from an average of 168,000 in 2024. Given that labour market activity is cooling, there is increasing concern that the Trump administration’s efforts to trim the size of the federal workforce will cause a surge in unemployment and undermine consumer spending. In our assessment, this view overlooks several important features of the U.S. labour market.

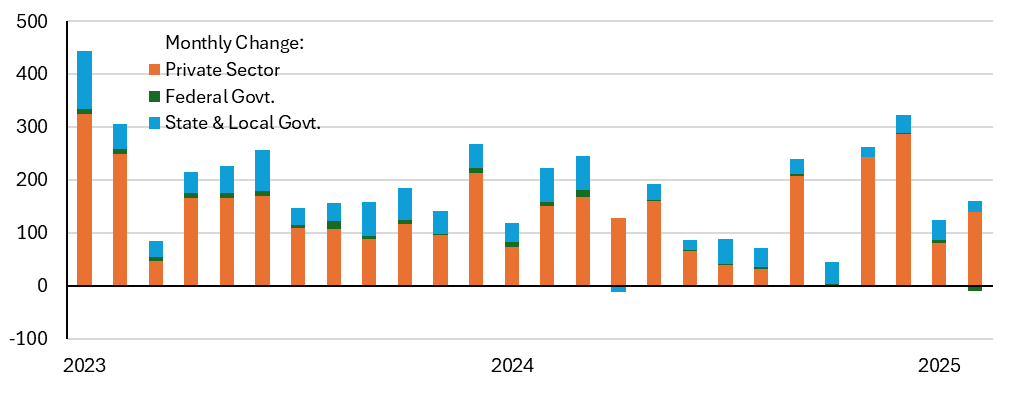

First, year-to-date private sector job creation of 221,000 positions has more than offset federal layoffs of 10,000 (Chart 1). Federal employees make up just 1.9% of the total workforce, and layoffs in this segment of the labour market are unlikely to trigger a rapid uptick in overall joblessness.

U.S. Employment monthly change (in thousands of employees)

Second, the number of federal layoffs may have little bearing on consumption as many affected workers have accepted buyouts with pay while others have retired. Finally, federal job losses must be understood in the context of a labour force totalling nearly 160 million people. About 5 million workers, or 3% of the labour force, switch jobs every month. While some former federal employees and contractors may have a difficult time finding a new job, others may be re-hired promptly in the private sector.

On balance, unemployment and wage measures show labour market conditions continue to loosen in a gradual, rather than abrupt, manner. The unemployment rate has risen from a trough of around 3.5% in early 2023 to 4.1% in February, still a very low level by historical standards. Moderately higher unemployment has allowed wage growth to stabilize at a lower, more sustainable rate of around 4% year-on-year, helping to reinforce recent progress on inflation.

The primary risk to our positive forecast for consumption is the possibility that a negative wealth effect, rather than a jump in unemployment, impairs consumer spending. Indeed, the top income quintile of Americans accounts for about 40% of total private expenditures. Should stock market turbulence lead to a fall in confidence among asset-rich households, this could have a pronounced impact on consumption. In our assessment, higher income earners are well positioned to continue to make a positive contribution to overall consumer spending despite recent market volatility. We anticipate aggregate consumption will slow, but remain positive, in the coming months and are keeping a watchful eye for any signs of weaker demand among more affluent households.

At present, prospects for private spending – the main driver of the U.S. economy – are constructive, but outlooks vary for other areas of domestic demand. Business investment has stalled in the past several quarters and is unlikely to improve against a backdrop of elevated trade uncertainty and financial market volatility. On the fiscal side, the new administration’s agenda of deregulation and tax breaks could prove marginally positive although little details have been released at this time. We also note that the federal budget deficit currently stands at 7.6% of GDP, affording limited scope for fiscal policy to boost activity this year.

Aggregating these factors within the broader context of global trade headwinds, we conclude that U.S. growth will decelerate in 2025 though we do not envision a recession. We forecast U.S. real GDP growth to moderate to between 1.0-2.0% in 2025.

The Canadian economy is more resilient than investors are discounting

Canadian real GDP expanded by 0.6% quarter-on-quarter in Q4. Household spending increased 1.4% and business investment rose 2.0% from the previous quarter, indicating solid domestic demand. In the same period, exports jumped 1.8% quarter-on-quarter as U.S. customers stockpiled Canadian goods ahead of potential trade disruptions. The solid overall performance of the Canadian economy in Q4 helped raise full-year real GDP growth to 1.6% in 2024.

Consumers are well positioned to remain the driving force behind economic activity in 2025. While the unemployment rate (6.6%) is higher than a year ago (5.9%), the rise is not due to an uptick in job losses. Rather, it is a consequence of labour force growth outpacing employment growth. Indeed, the Canadian economy added 387,000 jobs over the last twelve months compared to an expansion in the labour force of 572,000 people over the same period.

Meanwhile, the Canadian workforce continues to enjoy healthy wage growth. Average hourly earnings rose by 3.8% year-on-year in February, tracking ahead of inflation (2.6%). Steady employment and wage gains have helped households maintain healthy balance sheets. The personal savings rate stands at 6.1%, well above pre-pandemic norms, a sign that Canadians are continuing to add to savings. Household finances vary considerably across the income distribution but, in aggregate, the outlook for consumption remains positive given healthy fundamentals.

Tariffs notwithstanding, none of the typical factors that trigger a sharp downturn in activity are in place. There are no distortions in the Canadian financial system or excessive imbalances in the economy. Credit losses are low by historical standards, while households have built substantial equity in their homes which helps limit increases in their debt service costs. In addition, banks have built reserves over the past two years and are well positioned to absorb economic shocks and sustain lending. Inflation is muted, creating room for the Bank of Canada to continue loosening monetary policy, further reducing the risk of a liquidity shortfall.

The threat of tariffs complicates what is otherwise a relatively sanguine outlook for the Canadian economy. A 25% broad-based tariff on Canada would be a major growth shock if sustained over an extended period. Nonetheless, we believe it is premature to forecast a recession. The Canadian economy entered this tumultuous phase in a resilient state, and Canada possesses offsets to tariff risks – an underappreciated point we elaborate upon below.

We expect Canadian real GDP to expand by 0.5-1.5% in 2025, a positive rate of growth yet lower than the IMF’s current forecast of 2.0%.

Eurozone stuck in low growth trend

Eurozone real GDP advanced 0.2% quarter-on-quarter in the last three months of 2024, following a 0.4% expansion in Q3. On an annual basis, the economy grew just 0.9% in 2024. Uneven regional growth and sluggish domestic demand continue to weigh on the outlook for the Eurozone.

The Eurozone’s two largest economies faced challenges in Q4. Real GDP contracted 0.2% quarter-on-quarter in Germany, while output also fell in France (-0.1%). Italy recorded a mild 0.1% expansion in the same period and Spain grew an impressive 0.8%, proving an outlier amid the regional trend of stagnating activity. Lackluster consumer spending remains a challenge across the Eurozone.

Eurozone countries are beginning to enact fiscal policy measures to boost growth. Germany recently approved a plan to increase security and defence spending, along with creating a €500 billion climate and infrastructure fund. The potential for monetary support is also increasing given recent progress on inflation. Headline inflation fell to 2.3% in February, marking the first deceleration in consumer price growth in four months, and cooled further to 2.2% in March. In the same period, core inflation and services inflation – two closely watched measures of domestic price trends – both edged lower.

Tepid growth, easing price pressures and potential U.S. tariffs all suggest the ECB will stick to its plan to lower rates this year. Recent action by the central bank confirms this view. In March, the ECB reduced its benchmark interest rate by 25 basis points (bps) to 2.5%, the sixth cut in the last nine months.

We expect activity in the Eurozone will remain soft, but fiscal and monetary policy support will help the region deal with headwinds. Our forecast is for Eurozone real GDP to advance between 0.5-1.5% in 2025.

Chinese activity picks up on stimulus

China’s real GDP expanded 5.0% year-on-year in 2024. Economic releases generally improved toward year-end, following a series of stimulus measures launched in September. More timely data suggests momentum has successfully carried into 2025.

Through the first two months of the year, retail sales grew 4.0% year-on-year, a modest uptick from the 3.7% rate of growth observed in December. Industrial sector activity – a key engine of growth last year – recorded a healthy 5.9% expansion in the same period. Meanwhile, investments in manufacturing (+9.0%) and infrastructure (+5.6%) continued to offset declining real estate investment (-9.8%).

Broad domestic activity has picked up lately and there are numerous indications that policy will remain supportive. Indeed, announcements from China’s National People’s Congress meeting in March promise additional stimulus. The central government’s budgeted deficit of 4% of GDP marks the highest figure in years and implies a positive fiscal impulse worth around 1% of GDP in 2025. Meanwhile, policymakers also announced the ongoing trade-in subsidy scheme, a program providing incentives on purchases of vehicles, appliances and other consumer goods, will double in size to total 300 billion yuan.

While domestic conditions are improving, external pressures are building. The U.S. imposed a cumulative 54% tariff on all Chinese goods, and other punitive measures are possible. However, we believe further trade disruptions will trigger additional monetary and fiscal easing. As we cover in greater detail below, China, like many major economies, has the capacity to cushion the blow of tariffs. Though prospects vary under different tariff and policy-response scenarios, the government recently announced a GDP growth target of “about 5%”, a level similar to the IMF forecast of 4.6% in real annual terms in 2025.

Diverging growth paths in emerging markets

India grew faster than any other major economy in 2024 as real GDP advanced 6.5% year-on-year. Early indicators of activity for 2025 remain robust, suggesting this trend will persist. Indeed, the HSBC India Composite PMI stood at 58.6 in March, deep in expansionary territory and well above its long-term average of 54.1. The IMF’s forecast is for India’s real GDP to advance by 6.5% in 2025, underpinned by pro-growth fiscal policy and solid consumer demand.

Mexico slowed for a third consecutive year in 2024 as real GDP growth moderated to 1.2% in annual terms, undershooting the IMF’s forecast of 1.8%. Looking ahead, activity is likely to trend lower. Fiscal policy is positioned to be less supportive this year given efforts to rein in the budget deficit. On the monetary policy front, the Central Bank of Mexico has cut the benchmark interest rate by a cumulative 225 bps since March 2024. With more rate cuts expected, looser financial conditions should help offset fiscal headwinds. According to the IMF, Mexico is on track for real GDP growth of 1.4% this year. However, weaker than expected growth in Q4 and tariff-related disruptions suggest this figure is likely to see a downward revision.

In Brazil, economic growth and labour market dynamics are robust but expected to cool in the months ahead as high interest rates weigh more heavily on economic activity. The IMF anticipates real GDP growth will moderate to 2.2% in 2025. The prospect of additional monetary tightening – the benchmark Selic interest rate is already a restrictive 14.25% – introduces the risk of a bigger-than-expected deceleration from last year’s 3.7% real GDP growth.

The outlook for emerging markets is characterized by divergent growth paths and risks at the country level. In aggregate terms, however, emerging market activity is forecast to remain stable, reflecting consistent growth in India and recoveries in several frontier economies that struggled in 2024. The IMF forecasts emerging market real GDP growth of 4.2% in 2025.

Tariffs a significant but navigable risk

The U.S. administration’s imposition of 25% tariffs on goods from Canada and Mexico, additional levies on Chinese imports, and sweeping reciprocal tariffs on the majority of its remaining trade partners prompted a sharp pullback in global equity markets. Though the U.S. implemented a partial reprieve for Canada and Mexico, providing an exemption for goods that meet the rules of the 2020 USMCA free-trade agreement, and applied a lower 10% tariff rate to several countries, concerns over the economic impacts of trade upheaval have intensified. Meanwhile, conditions for a resolution remain unclear.

There is an increasing risk that uncertainty alone will curtail investment and hiring decisions in the interim. Meanwhile, estimates of the direct impact of proposed U.S. tariffs are sizeable. The Bank of Canada anticipates a 2.5% drag on the Canadian economy in the first year of implementation, which would imply a recessionary scenario of around -1% to -2% real GDP growth. Mexico’s economy would face a comparable hit. The first trade war is estimated to have lowered China’s real GDP growth by about 0.7% in 2018-2019, and given the similarity of tariff rate increases and export exposure, China could see an equivalent headwind to growth this time around.

As explained in our February Research Insights Webinar, a key point to consider when evaluating the potential impact of U.S. tariffs is that economies are dynamic, not static, and countries possess many levers to cushion the blow. Thanks to significant progress on the inflation front over the last two years, the Bank of Canada has plenty of room to manoeuvre. Canada’s benchmark interest rate of 2.75% is still well above its pre-pandemic level of 1.75%, and we expect the central bank to cut rates further should the need arise. Of note, the Bank of Canada lowered its policy rate by 25 bps in March, citing tariff uncertainty. Policymakers in Mexico, China and Europe have similar capacity to cut interest rates and support domestic activity.

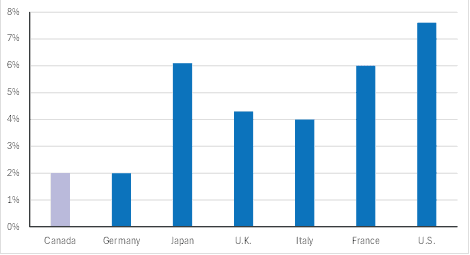

Fiscal policy can also be used to address tariff-related challenges. Canada is particularly well-positioned in this regard, boasting one of the lowest deficit-to-GDP ratios among G7 nations (Chart 2). This affords federal and provincial governments scope to provide stimulus in response to external challenges. Were Canada to increase its deficit from 2% of GDP to 7.6%, the prevailing level in the U.S., the GDP hit of a 25% U.S. tariff could be entirely offset.

Fiscal policy is well-suited to mitigate tariff shocks and will play an important role in determining growth outcomes should tariffs persist.

G7 Budget Deficits (Percent of GDP)

Currencies also have the potential to dull the impact of tariffs. At present, based on our purchasing power parity model, we estimate the Canadian dollar to be 26% undervalued relative to the U.S. dollar, a multi-decade low. Not only does this degree of undervaluation suggest limited downside for the CAD, but the currency’s weakness should also help maintain the competitiveness of Canadian exports in the event of costly duties. Similarly, we estimate the Euro and Mexican Peso to be undervalued relative to the USD by 15% and 20% respectively. At present, the currencies of regions targeted by U.S. tariffs are trading at significant discounts to the USD which should provide a buffer against trade disruptions.

In sum, there are several effective countermeasures to tariffs. While circumstances vary on a country-by-country basis, most major economies are equipped to navigate trade headwinds. Meanwhile, indicators of domestic activity are generally in good shape across the global economy. The risk posed by tariffs is substantial, but in our assessment, are unlikely to derail global growth in 2025.

Markets fluctuate amid heightened concerns

A tech sector sell-off and the uncertainty caused by escalating trade tensions led to mixed equity market performance in the first quarter. The S&P 500 fell 4.2% (year-to-date total return in Canadian dollars), and the MSCI ACWI recorded a 1.5% pullback. In contrast, the S&P TSX (+1.5%), MSCI EAFE (+6.9%), and MSCI Emerging Markets Index (+3%) all registered Q1 gains.

We have repeatedly cautioned that some areas of the market were particularly exposed to a reversal in sentiment. In our assessment, the extreme levels of index concentration in the Magnificent 7 stocks, the historically elevated index multiples, especially in the U.S., as well as the optimistic earnings assumptions behind some of these companies’ valuations and prices, were clear signs of euphoria. Illustrative of this point, March’s tech-led sell-off saw the Magnificent 7 stocks collectively fall more than 20% from December highs even as they reported relatively strong fourth quarter profits.

Despite evidence of investor sentiment recalibrating, the Magnificent 7 stocks continue to trade at an elevated equal weighted average forward P/E of 27.1. Given the outsized footprint of these companies in broad market indices – the group still accounts for more than 30% of the S&P 500 – we caution that market volatility could intensify if these companies’ results fall short of high investor expectations in the coming months.

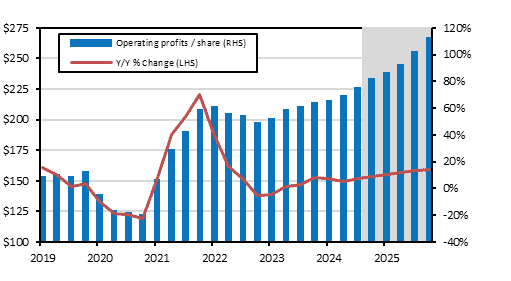

Our concern about high valuations and earnings forecasts extends beyond this small subset of tech-related stocks. Indeed, earnings growth estimates remain elevated for the broader market. Consensus forecasts are for S&P 500 profits to rise 16% year-on-year in 2025 (Chart 3). Against a backdrop of 1-2% real GDP growth and elevated policy uncertainty, this seems like a high bar. In our opinion, the disconnect between economic fundamentals and investor expectations highlights a significant behavioral risk still embedded in equity markets.

S&P 500 Profits / Share

We maintained an overweight in equities for several years, however given the views outlined above, we have now brought our balanced portfolios more in line with their mandated targets by reducing holdings that have achieved or exceeded our valuation and return targets. Our equity mandates have similarly seen a meaningful rise in cash reserves. As for redeploying portfolio capital, we remain committed to the principle of price discipline, meaning that at this juncture we are comfortable holding a moderate level of cash. We are confident this measured approach will allow us the flexibility to capitalize on market dislocations in a potentially tumultuous period for equities.

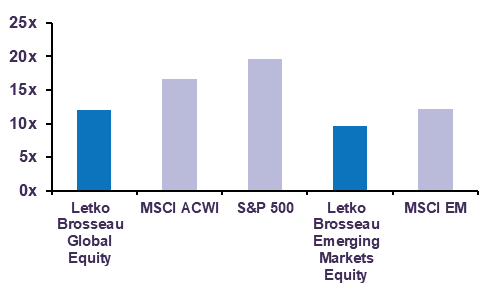

While the outlook for company earnings is tempered by slower economic growth and trade headwinds, we believe our portfolio companies can endure an environment characterized by more challenging fundamentals. Our equity holdings are well diversified across sectors and geographies and have strong earnings prospects over our 3-to 5-year investment horizon. From a valuation standpoint, the Letko Brosseau global equity and emerging markets equity portfolios trade at a compelling 11.8 and 9.8 times 2025 earnings respectively, substantial discounts to their benchmarks (Chart 4).

Forward Price-to-Earnings Ratio

Turning to fixed income, we continue to focus on capital preservation and are seeking to minimize risks in our bond holdings by prioritizing credit quality and avoiding long duration securities. As we have explained in past reports, longer-dated Canadian bonds remain expensive relative to our fair value estimates. While it may seem enticing to increase our duration given the uncertainty surrounding the global economy, the effect of tariffs on inflation argues against this idea. Were inflation to increase and remain elevated while the economy adjusts to potential trade disruptions, long-term bonds could be under pressure.

Our base case forecast is for global economic activity to continue to expand in the year ahead. Overall, we remain optimistic about the return opportunities in our portfolios, and we believe a patient and consistent approach in the face of volatility will be rewarded in the medium term.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN